Rich Dad Poor Dad by Robert Kiyosaki (Detailed Summary)

Rich Dad Poor Dad is a 1997 book written by Robert T. Kiyosaki and Sharon Lechter. It advocates the importance of financial literacy, financial independence and building wealth through investing in assets, real estate investing, starting and owning businesses, as well as increasing one’s financial intelligence.

What are the main points of Rich Dad Poor Dad?

- The rich make their money work for them.

- Financial education is your greatest asset.

- Know the difference between assets and liabilities.

- Don’t be controlled by emotions.

- Work to Acquire Life Skills, Not for Money:

- Failure inspires winners and defeats losers.

- Learn to manage risk.

- Mind your own business.

“Rich Dad Poor Dad” is a progressive individual financial book that has caught the consideration of millions of readers around the world. Composed by Robert Kiyosaki, this book challanges the standard way of thinking of the conventional schooling system and urges people to contemplate cash and financial planning.

The reason for this article is to give a definite synopsis of “Rich Dad Poor Dad” and its key subjects, examples, and focus points.

.

Who is Robert Kiyosaki?

Robert Toru Kiyosaki is an American entrepreneur, businessman and author. Kiyosaki is the founder of Rich Global LLC and the Rich Dad Company, a private financial education company that provides personal finance and business education to people through books and videos.

What are the Six Lessons in Rich Dad Poor Dad?

His book “Rich Dad Poor Dad” draws from his own experiences and those of his two fathers – one who was highly educated but financially struggling (the “Poor Dad”), and the other who was less formally educated but financially successful (the “Rich Dad”). Through his book, Kiyosaki shares valuable insights and practical advice that can help individuals achieve financial freedom.

The overarching theme of Rich Dad Poor Dad is how to use money as a tool for wealth development. It destroys the myth that the rich are born rich, explains why your personal residence may not really be an asset, describes the real difference between an asset and a liability, and much more.

1. Monetary Training

Monetary training is a critical part of creating financial stability and accomplishing independence from the rat race, and “Rich Dad Poor Dad”underlines its significance all through the book. Kiyosaki contends that traditional education doesn’t get ready people for monetary achievement and that gaining monetary proficiency is fundamental for exploring the intricate universe of cash and financial planning.

2. The Distinction Among Asset and Liabilities

An asset is something that places cash in your pocket, while an liability is something that removes cash from your pocket. Kiyosaki urges readers to focus on obtaining resources, for example, investment properties or other money streaming resources, that produce recurring, automated revenue and create long-term wealth.

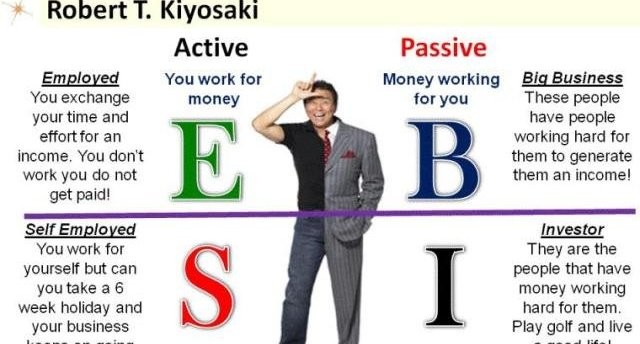

3. The Power of Passive Income

Passive income is one more focal subject of“Rich Dad Poor Dad.” Kiyosaki stresses the significance of various revenue sources, which can give a pad against monetary instability and the opportunity to seek after your interests and passion. The book gives functional exhortation on building passive sources of income and ceaselessly growing an asset portfolio over time.

4. Cash Flow

Cash Flow is a basic part of individual budget and wealth building, and the book features its importance all through the book. Kiyosaki contends that people should comprehend the contrast inflows and outflows of money to build wealth and achieve financial freedom He urges readers to zfocus on expanding their inflows, for example, through automated sources of income, and lessening their surges by staying away from liabilities to accomplish positive income.

5. Taxes

Taxes are one more basic part of individual accounting and growing a substantial financial foundation, and “Rich Dad Poor Dad” underlines their effect on creating financial stability. Kiyosaki contends that people should figure out the assessment ramifications of their monetary choices and endeavor to limit their taxation rate to amplify their abundance. He urges readers to look for an expense proficient’s recommendation and comprehend the tax laws and regulations that apply to their financial situation to make informed decisions about their finances.

6. Consistent Learning and Development

This is fundamental for individual and monetary achievement. Kiyosaki contends that people should consistently learn and develop to remain ahead in the quickly impacting universe of money and financial planning. He urges readers to search out new information, go ahead with carefully thought out plans of action, and embrace change to accomplish independence from the rat race. The book gives common sense exhortation and systems to fostering a long lasting learning outlook and consistently growing one’s monetary information and abilities. He teaches that readers should work jobs to learn and that the skills, knowledge, and experience they gain are more important than the paycheck.

Reactions of the Book

In spite of its boundless fame, the book has been scrutinized for distorting complex monetary ideas and not giving satisfactory detail on individual accounting, effective financial planning, and business mechanics. A few critics state that its recommendation and techniques may not be reasonable for all people and that a more nuanced way to deal with personal finance is necessary.

Focuses Heavily on Real Estate

An evaluate of the book is that it depicts land speculation as the main way to riches, ignoring other expected wellsprings of automated revenue like stocks or bonds. This limited concentration, some contend, may not be fitting for everybody and that an expanded venture portfolio is vital for monetary security.

Short on details

The book has been criticized for lacking particularity in effective financial planning mechanics, leaving readers with a general comprehension of ideas as opposed to substantial moves toward carry out them. Some battle that the book’s recommendation is too expansive and that people require more specific actionable guidelines to attain financial freedom.

Key Important points from the Book

Different Revenue Sources

Different revenue streams are fundamental for monetary security and opportunity, and the author gives viable counsel on building them. Kiyosaki contends that depending on a solitary type of revenue is hazardous and that people ought to endeavor to have numerous wellsprings of automated revenue to give financial stability.

Taking Calculated Risks

Taking Calculated Risks is a fundamental part of growing long term financial stability, and the book underscores its importance all through the book. Kiyosaki contends that risk-taking is a characteristic piece of the growing a substantial financial foundation interaction and that people ought to embrace it to accomplish independence from the rat race. He urges perusers to be strong, go ahead with reasonable courses of action, and persistently learn and develop.

Financial Education

Financial literacy and training are basic parts of creating financial wellbeing; he underlines their significance all through the book. Kiyosaki contends that customary schooling doesn’t give the monetary information important to progress and that people should volunteer to gain monetary education. The book gives viable guidance and systems to securing monetary information and fostering a growing a strong financial foundation mentality.

Attitude

Attitude is one more vital part of establishing financial stability, and the book features its importance all through the book. Kiyosaki contends that a singular’s outlook and perspectives toward cash and contributing can altogether influence monetary achievement. He urges readers to foster a development mentality, embrace risk-taking, and be available to learning and new encounters. People can defeat restricting convictions and accomplish independence from the rat race by moving their attitude and mindset.

What are the Advantages of Perusing Rich Dad Poor Dad?

‘Rich Dad Poor Dad’ lastingly affects the universe of individual budget, dazzling the creative mind of millions of readsers universally with its inventive way to deal with growing long term financial stability. Through its emphasis on financial literacy and education, the distinction between assets and liabilities, the potency of passive income, and the influence of mindset, the book provides insightful and practical guidance for those seeking financial freedom.

Notwithstanding confronting analysis, the persevering through prevalence of “Rich Dad Poor Dad” validates its capacity to rouse and inspire readers to assume responsibility for their funds and build wealth. Its message of financial independence and empowerment continues to resonate with individuals today.

It’s a must-read for anyone with any interest at all in personal accounting and growing long term financial stability. Whether you’re simply beginning your financial journey or are knowledgeable about finance, the book’s examples and standards offer important experiences and motivation.

An interesting and pragmatic aide can assist you with achieving independence from the rat race and carry on with your ideal life.

My Viewpoint About “Rich Dad Poor Dad”

I found“Rich Dad Poor Dad” to be one of the best personal finance book I have at any point read, and the standards inside it changed my monetary perspective and, over the long run, transformed me. Kiyosaki has a whole series of books for more advanced details on investing, taxes, and business.

-

-

1 week

Tagged Brain power, Happiness, Productive